Some Of Medicare Advantage Agent

An exterior testimonial is executed by an exterior testimonial company gotten by the Massachusetts Office of Patient Defense. You should request for an outside appeal from the Massachusetts Workplace of Client Defense within four months of obtaining the decision on your inner charm. Your inner charm notice must provide the type to request an exterior review and various other information regarding requesting an outside review.

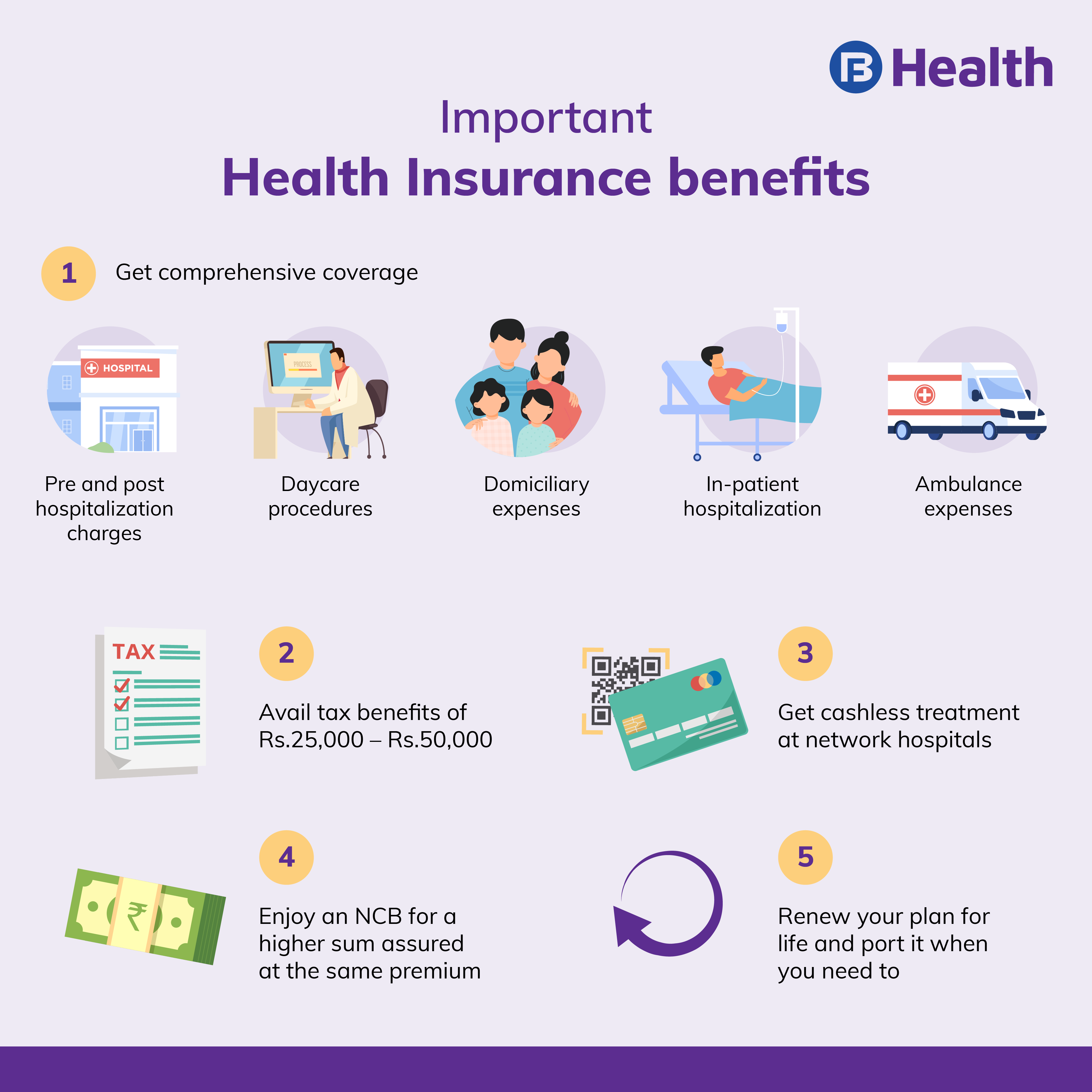

Wellness insurance coverage consistently rates as one of the most vital benefits among staff members and task applicants alike. Supplying a group health insurance can aid you preserve an affordable advantage over various other employers particularly in a limited job market. When workers are fretted concerning how they're going to manage a clinical problem or pay for it - they can end up being worried and distracted at the office.

It likewise uses them satisfaction recognizing they can manage care if and when they need it. Medicare Advantage Agent. The decision to use staff member health benefits usually comes down to a matter of cost. Numerous little organization proprietors overlook that the premium the amount paid to the insurance provider every month for coverage is usually shared by the employer and staff members

A Biased View of Medicare Advantage Agent

These alternatives can include clinical, dental, vision, and extra. To be eligible to enroll in wellness protection via the Market, you: Under the Affordable Treatment Act (ACA), you have special person security when you are guaranteed with the Health Insurance Policy Marketplace: Insurance firms can not decline insurance coverage based on gender or a pre-existing problem.

No one intends to get truly unwell or pain. If you get health insurance coverage, it can conveniently cost you less money than going to the health center without it.

Wellness insurance policy still sets you back cash and picking the ideal plan for you can be difficult. Medicare Advantage Agent. What if you already have insurance policy?

Learn concerning the kinds of advantages to anticipate when you have wellness insurance. Discover a lot more regarding the expense of health and wellness insurance consisting of points like co-pays, co-insurance, deductibles, and costs.

The smart Trick of Medicare Advantage Agent That Nobody is Discussing

It will certainly summarize the crucial features of the strategy or coverage, such as the protected benefits, cost-sharing stipulations, and protection limitations and exemptions. People will receive the recap when purchasing coverage, enlisting in protection, at each new plan year, and within 7 business days of asking for a duplicate from their medical insurance company or team health insurance plan.

Many thanks to the Affordable Care Act, customers will certainly likewise have a brand-new resource to assist them recognize some of the most typical yet complex jargon utilized in medical insurance (Medicare Advantage Agent). Insurer and team health plans will certainly be called for to make available upon request an uniform reference of terms frequently made use of in health insurance coverage resource such as "deductible" and "co-payment"

Wellness insurance coverage in the U.S. can be complex. Lots of people do not have access to excellent insurance coverage they can afford, and numerous people don't have any type of health insurance policy in any way. There are plenty of broad view changes that the federal government requires to make so that medical insurance works much better.

A Biased View of Medicare Advantage Agent

"Oftentimes insurer also make modifications to advantages in terms that are normally applicable upon revival of the policy, and so you desire to make certain that you're assessing those and you comprehend what those see this site adjustments are and exactly how they might impact you," Carter states. It's additionally worth checking your advantages if your wellness has transformed recently.

"If customers can merely make the review of their health and wellness insurance coverage policy a typical practice, it's something that ends up being less complicated and easier to do in time," claims Carter. Just how much you use your wellness insurance depends upon what's happening with your health. An annual physical with your medical care doctor can keep you updated with what's taking place in your body, and offer you a concept of what kind of healthcare you may need in the coming year.